African renewables’ persistent commercial debt deficit

A review of the IFC’s scaling solar initiative, and what it says about the African project finance market.

It is easy to be cynical about the role of blended finance in emerging markets energy and infrastructure finance. It can sometimes seem like a rebadging of development finance institutions’ decades-long effort to increase the use of B loans by commercial banks and other DFIs.

But given that DFIs have finite resources, and that these resources are dwarfed by the demands of decarbonisation, electrification, and economic growth in emerging markets, the promise of blended finance – mobilising more capital than DFIs have at their disposal – remains valid. And given the political and economic risks of working in the poorest emerging markets, DFIs are likely to remain anchor lenders.

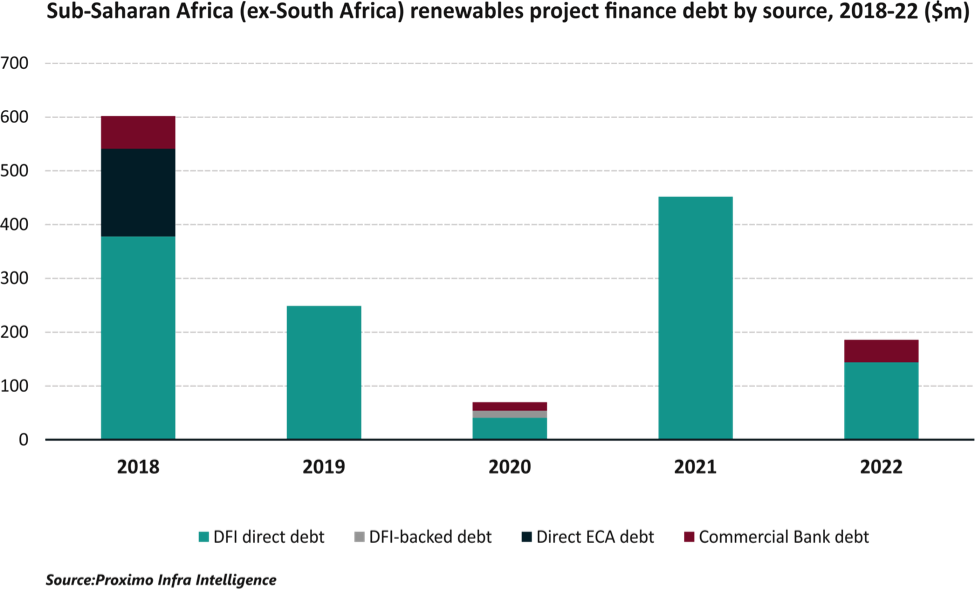

But African renewables, like African conventional power before it, essentially remains the preserve of DFIs. According to data held by Uxolo's sister publication Proximo, DFI direct loans account for the overwhelming majority of volumes of debt for renewables projects in Sub-Saharan Africa, once the anomalous South African market is excluded. Even direct debt from export credit agencies is rare, and ECA-backed debt for non-recourse financings in the region is non-existent.

The above is the context for a review of the International Finance Corporation’s Scaling Solar initiative published by the Energy For Growth Hub. The author is Teal Emery, a researcher and former analyst at Morgan Stanley Investment Management, and consultant for the World Bank.

The IFC launched Scaling Solar in 2015, with the aim of streamlining procurement and financing processes in emerging markets. It made a strong initial splash, when the government of Zambia managed to tender 88MW of capacity to a consortium of Neoen and First Solar (54MW) and Enel Green Power (34MW).

Only two further projects reached financial close under the umbrella of Scaling Solar – twin plants with a total capacity of 60MW in Senegal and Masdar’s 100MW Nur Navoi project in Uzbekistan. It’s easy to agree with Emery’s conclusion that Scaling Solar has not been a success. Uzbekistan has gone onto greater things, but primarily in wind. Africa remains a backwater in renewables project finance.

Emery analysis of the Zambian projects’ procurement and financing notes that the process, despite the influence of Scaling Solar, was not as transparent as it needed to be, that the eye-catching tariffs that the procurement attracted were not sustainable, and that the tariffs may have scared off other, more realistically-priced, investments in the sector.

The paper is generally supportive of the framework that the IFC created for project procurement. For small jurisdictions creating bespoke power purchase agreements and bidding rules can be expensive and counter-productive. DFIs have rightly focused, even outside the Scaling Solar initiative, on improving project preparation capacity in emerging markets.

And Uxolo shares Emery’s frustration with the inability of third parties to assess debt pricing on DFI loans in emerging markets. DFIs have generally acceded to sponsors’ requests to keep pricing details confidential, even where more disclosure might improve market efficiency, and it is possible they might have benefited from that limited disclosure in defending their franchise.

As it is, the author is left trying to understand what component of the $0.06 per kW tariff was down to dirt-cheap DFI debt pricing, and what was down to tax and other implicit and explicit subsidies. For the latter, Emery refers to a USAID report that suggests strongly that post-award negotiations of favourable tax treatment might have been used to soften the impact of an aggressive upfront bid. As it is, his attempts to unpick the pricing subsidy are impressive.

The Uxolo perspective

Perhaps the main divergence between Uxolo and the paper comes in assessing whether Scaling Solar managed market expectations effectively. It’s not clear from what the IFC said about the programme whether it felt that the initiative was designed to access particularly large volumes of commercial bank debt. Certainly it was designed to attract private sector equity, and a well-assembled PPA and bidding programme was important for attracting that equity.

Whether the remaining parts of the programme, in particular World Bank partial guarantees for PPA obligations and bundled political risk insurance, were really primarily for commercial lenders or primarily for equity investors is open to question. Certainly the public pronouncements reviewed by Uxolo were studiously vague about the distinction between debt and equity, but IFC was clear that a stapled debt financing was a big part of its offering on Scaling Solar.

Certainly the aggressive pricing probably did raise market expectations about what the programme would achieve, though this was itself part of a worldwide trend of anticipating falls in construction costs on renewables projects that is now confronting a reality of commodity price inflation. By the same token the falls in commodities in the period immediately after the Zambian projects came online probably did not do wonders for the credit of the Zambian offtaker.

Zambia is also itself something of an outlier. It is unusually dependent on the health of a single commodity, copper, to an extent probably only rivalled by Chile. Zambia was very early to the privatisation party, selling off its transmission operations in the late 1990s. More recently it has become an avid customer of China’s Belt & Road Initiative, and is now enduring the aftermath of a fraught debt restructuring as a result of that overenthusiasm.

Still, it is probably fair to say that the effects of Scaling Solar, whatever the expectations, were relatively marginal and short-lived. Governments, as Emery notes, have gone back to dealing with developers, of a wide variability in quality, on a bilateral basis. And it is certainly true that DFIs probably need to be more transparent about the extent of the support required to build out renewables in Africa. Without it, the market is likely to remain a small and expensive club.