JPM DFI: It might not be a traditional DFI, but it doesn’t need to be

Three years ago, a couple of months before the Covid-19 pandemic began, JP Morgan launched the world’s first private DFI (JPM DFI). Adopting the DFI moniker has proven a double-edged sword, causing a compare-and-contrast with traditional DFIs. But perhaps a more productive analysis is to see JPM DFI for what it is – an example of private finance actively and intentionally engaging with development finance.

In a recent conversation with Faheen Allibhoy, the managing director of JPM DFI, Uxolo was walked through how the team engages with development finance. “The largest part of what we do is called our active business”, says Allibhoy, “let’s say you run a business and have an impact on your country, we can partner to help articulate the impact KPIs and metrics that can be put forward to potential investors and stakeholders”.

The DFI primarily offers advisory services such as impact template preparation, non-financial disclosure for bond offerings, and often acts as development finance structuring agent (DFSA). DFIs and ECAs frequently come into these transactions as anchor investors, such as in 2022 with Axian Telecom’s debut $420 million five-year bond which saw $50 million from IFC, $30 million from BII and further investments from DEG and EAIF. There was also the $150 million loan to Yilport Holdings, provided by DFC and of which $127 million was covered by BPI France, for the expansion of the Puerto Bolivar Port in Ecuador, one of the uncommon cases of ECA and DFI collaboration.

Beyond its advisory arm, the DFI is also able to offer a much broader set of public capital market products than traditional DFIs (due to licensing limitations) ranging from auto loans to hedges and swaps to bond underwritings. The latter two are frequent services JPM offers not just to private clients but also to the MDBs and DFIs too – “we work with them to raise money that they deploy in emerging markets”. There have also been some deals which JP Morgan has provided direct lending to, like the Uxolo-award winning COP877 billion ($201 million) loan to Findeter development bank covered by MIGA.

In comparison to DFIs

There are many similarities between the goals of the private DFI and its public peers – like being set up to spur more private capital into emerging markets. Firmwide, JP Morgan has also made a commitment to invest $2.5 trillion in green investments, development finance and community development by 2030, in line with global agendas like the Paris Climate Accords and the United Nations sustainable development goals (SDGs).

However, unlike the publicly-funded institutions, JPM DFI is actually composed of a team within the commercial bank. Its level of fees, offered products, and profit-focused mindset are therefore aligned with that of the JP Morgan Chase Group and other commercial banks.

While the goals of profit and positive social impact may, at first, appear at odds, the explosion of interest in impact investing says otherwise. JP Morgan took note of the growing interest in impact and ESG from its investor clients and, in its role as transaction matchmaker, recognised the opportunity to connect clients representing institutional capital with impact and ESG-focused transactions in emerging markets.

Borrowing from DFIs

Allibhoy is in no way new to development finance, having worked for 18 years at IFC as a principal investment officer and latterly country manager for Senegal. In particular, she highlights from her tenure the importance of the “intellectual capital” that MDBs and DFIs bring to bear when it comes to mobilising private capital. She says “working hand in hand with clients on the ground in emerging markets with technical assistance, due diligence capacity and relationships with governments” are all part of the multiplier effect that turns an MDB or DFI’s $1 into $3-4 of private capital.

Faheen Allibhoy

Indeed, she argues that “one of the most valuable things that the MDB community offers is their impact methodology, research, technical advisory, on the ground presence and policy advice, not just their financial products.” It is this facet that arguably sets JPM DFI apart from JP Morgan. All of the financial products employed by the DFI are complemented by its impact methodology, created in collaboration with IFC, assessing the ex ante and ex post impact of projects for investors. Rather than create another new index, the methodology heavily leans on best practices already created, like IFC’s sector-based metrics and GIIN’s IRIS+.

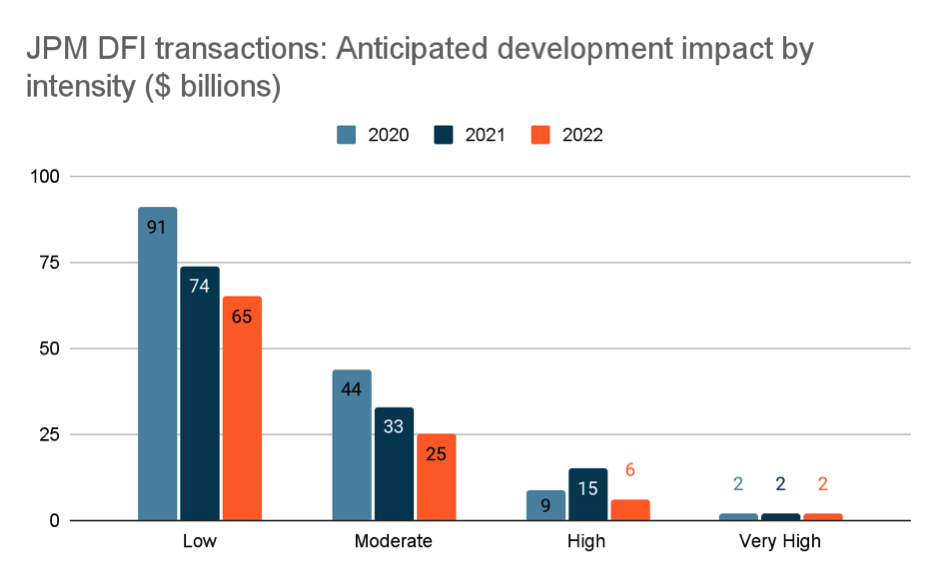

It is also in this respect that the DFI is trying to build sustainable development as a “traded asset class”. Allibhoy states she wants to move development impact from the “buy side to the sell side” by encouraging clients to intentionally consider impact in project/ deal development. According to the methodology, projects that declare their metrics and intended impact upfront receive a higher score, and part of what the DFI team does is retroactively go through JP Morgan’s transactions in emerging markets and score their development impact. However, as visible from the above chart, high impact scores remain nascent – mainly due to a lack of use of proceeds data provided by deal participants.

The Uxolo perspective

There are two ways of looking at JPM DFI. Arguably it is just a specialist advisory team within a commercial bank that very occasionally taps the JP Morgan balance sheet. But coextensively, it is creating big ticket transactions in emerging markets that are complemented by an MDB-approved, best practice impact methodology. So to say JPM DFI is nothing more than business as usual at JP Morgan would be to ignore the intentional creation of a DFI team actively engaging with DFIs and MDBs in the aim of private capital mobilisation.

It is widely known that the SDGs and Paris Accords will not be met without private capital and, in its three year lifespan, JPM DFI has shown that big commercial banking can work with development finance, albeit in a very different way to how MDBs and DFIs do development finance. It appears to be a symbiotic relationship; bonds arranged so far have been significantly oversubscribed, perhaps due to the commercial bank’s clout, but it will be the DFIs and MDBs that add comfort to the deal and slim down the pricing to appropriate development finance rates.

When asked how JPM DFI creates additionality, Alibhoy notes that: “[additionality] is a concept used by MDBs and DFIs to demonstrate how public money could be additional to private capital. In that way, it is very specific, and I think that parlaying over to commercial banking may not translate as well”.

Instead, she argues that mobilising private capital is one of the main objectives of the DFI, and something it is uniquely positioned to do by being so close to the investor base. She says, “we understand the types of transactions they are looking for: the ticket size, the geographies, the sector etc”.

Perhaps this summarises how JPM DFI can contribute to the development finance market – by harnessing its private-finance matchmaking mindset towards development finance deals, and enabling the capital gap to be bridged as a different kind of player on the field. In 2022, the team’s dealmaking raised $98 billion, almost the entire amount that developed countries have routinely failed to deliver to emerging markets for climate finance every year since their 2009 COP15 commitment. In the end, such numbers cannot be ignored.