The big one: Uxolo 2022 Development Finance Report

The Uxolo annual report is officially out, covering a year of development finance transaction activity against a background of conflating global crises. This first analysis takes a look at the report's highlights – the overview, currencies, and sectors.

The Uxolo 2022 Development Finance report is out and it throws up a few surprises – not least that Africa accounts for a larger share of development lending than it did in 2021, thanks to an almost doubling in activity in absolute terms.

The Uxolo annual report, now in its third year, is designed to map development lender activity and trends, and is based on the set of development finance data that Uxolo tracks each year. In 2022 Uxolo recorded 1,993 financings – an uptick on the previous year which captured 1,828.

The 2022 overview

Global crises, at least in recent years, have come along like buses – none for a long time, and then several at once. No sooner was the pandemic over, than inflation began to hit supply chains, and eventually interest rates, as central bankers rushed to keep a lid on price rises. Exacerbating these issues has been Russia’s invasion of Ukraine, which has led to dislocations in commodities markets and prompted DFIs active in the region to increase their support to Ukraine.

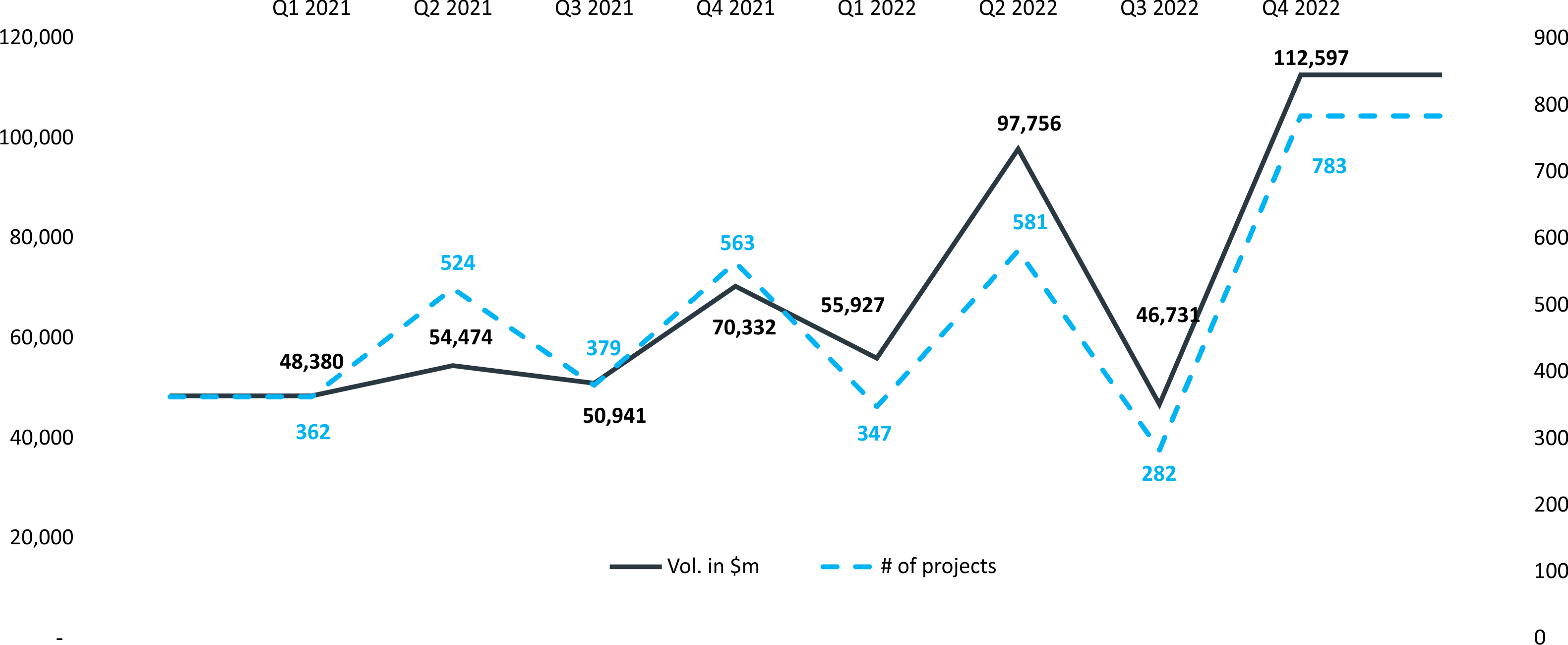

That confluence of problems made 2022 a difficult year for lenders and borrowers alike. But despite this, development finance transaction ticket sizes have grown since the end of the pandemic. The average development financing in 2022 – $157 million – was much larger than the $122 million average in 2021. The $224 billion in volumes in 2021 were spread over 1,828 transactions, while the $313 billion in 2022 volumes were spread over an only slightly greater total of 1,993 transactions. The eight largest transactions to be approved since the start of 2021 were all in 2022, with the ninth largest approved in 2023. The three largest financings were all direct consequences of the Russian invasion of Ukraine. A $13 billion initial package of assistance to the Ukrainian government, as well as a second $4.5 billion tranche, were the largest and third-largest development/relief financings.

Overall, 2022 saw a large jump in the dollar equivalent volume of approvals – from $224 billion to $313 billion. This sharp rise in approvals can be attributed to the world coming back to something approaching normal, with DFIs under less pressure to respond to the impacts of the pandemic.

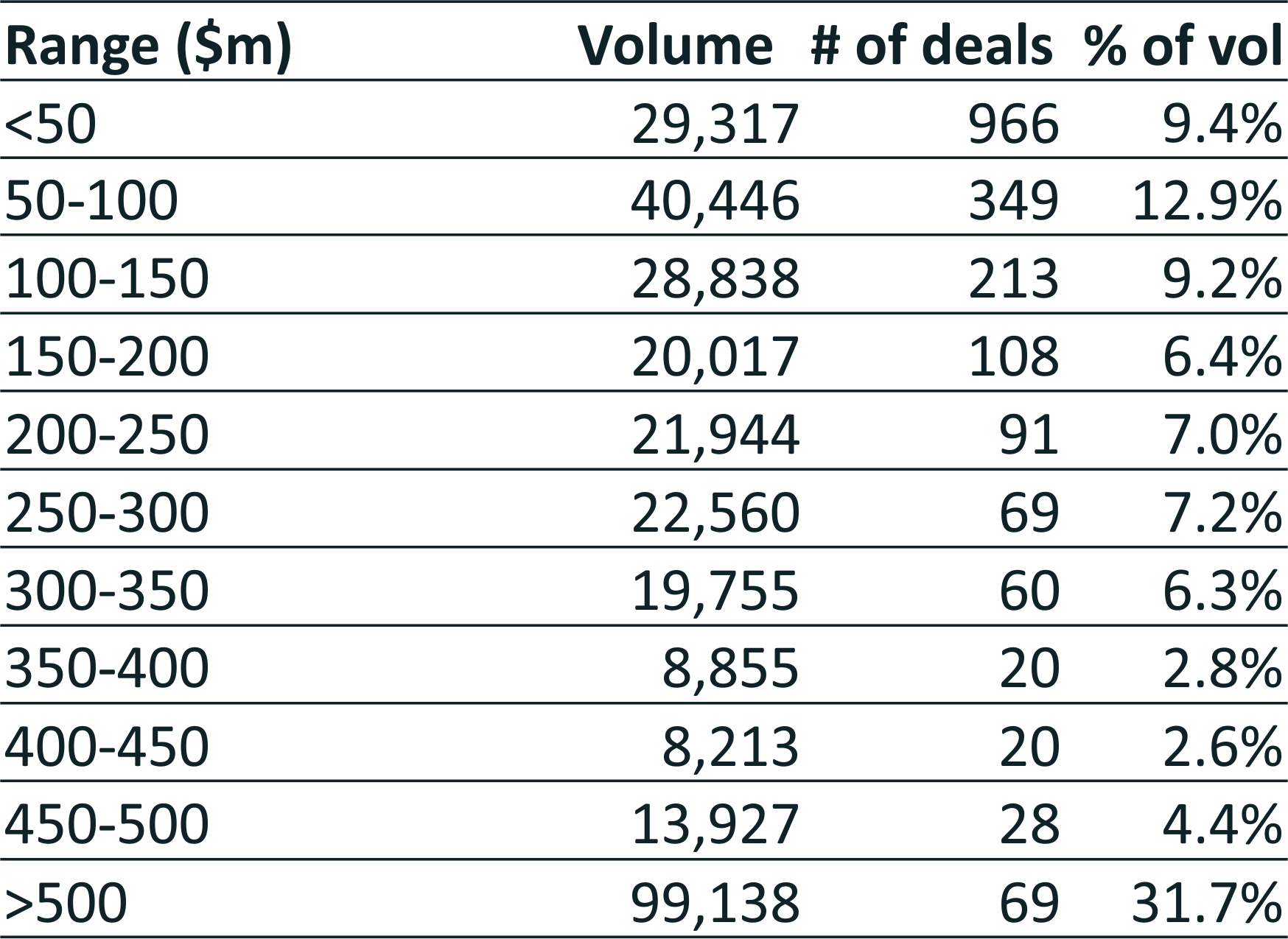

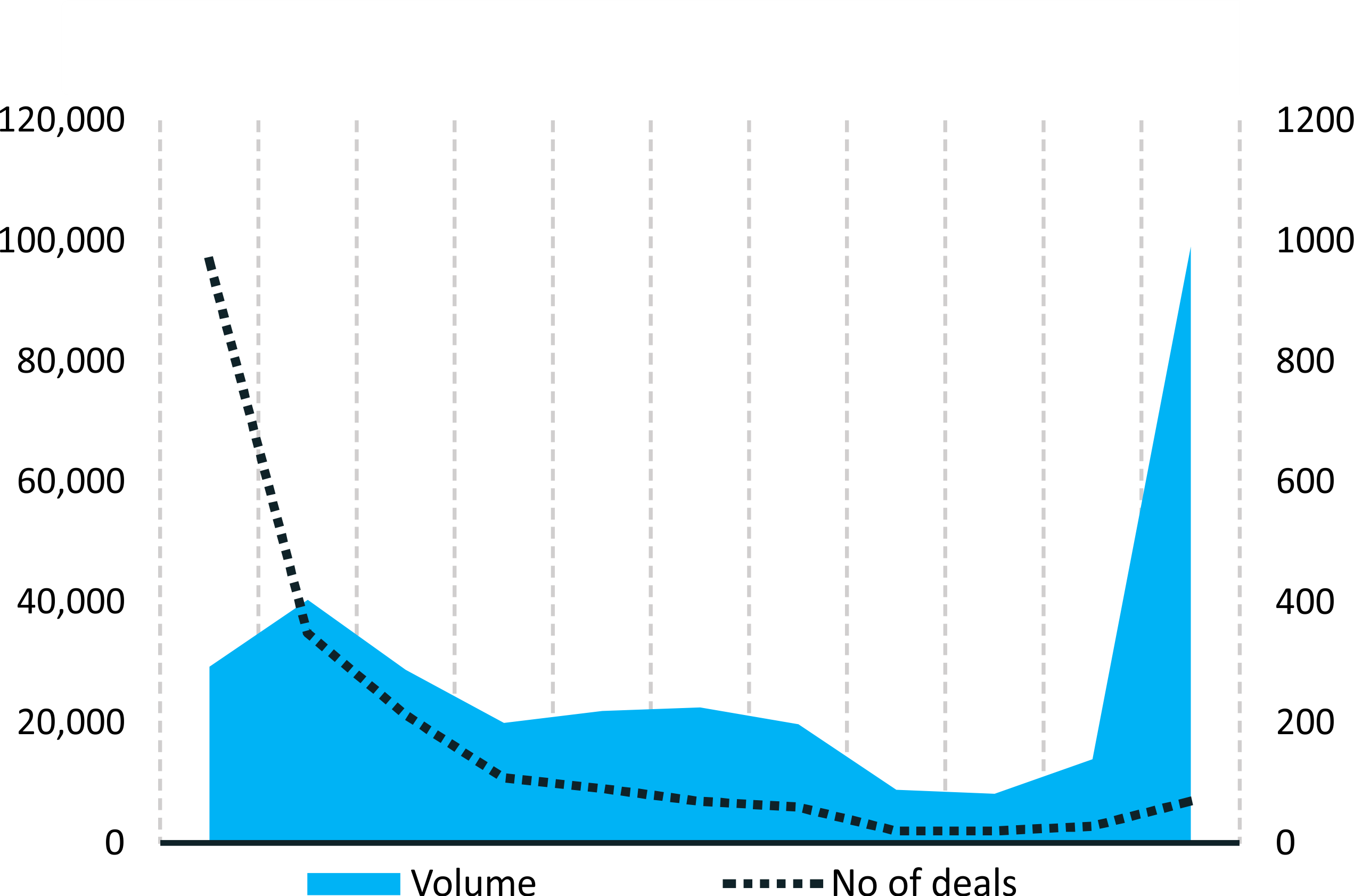

The contribution of big-ticket financings to 2022’s increase in volumes can be seen most clearly in the breakdown of transaction by size. The biggest-ticket financings – those of $500 million or larger – went from accounting for 21% of total volumes to just under 32%. With the exception of tranches of between $200 million and $350 million, which registered small increases in their share of volumes, all other tranche sizes reduced in popularity. The fall was most pronounced for the smallest transactions – those of less than $50 million. These financings did not even maintain activity levels in nominal terms, with fewer smaller financings getting approved.

How did currencies fare?

With lenders like NDB and AIIB having announced more locally denominated lending strategies – NDB alone plans to offer 30% of its loans in local currency, up from 22% at present – dollar dominance may begin to ebb a little. Already a side-effect of the Ukraine conflict has been a small reduction in the importance of the US dollar in development finance in 2022. But this reduction should not be overstated – the drop is from 67% of all volumes to 61%, and in absolute terms still increased from $116 billion to $193 billion. But packages of aid to Ukraine and German energy importers, as well as the traditional big-ticket European Investment Bank financings, helped boost the Euro’s presence.

Among the other currencies, the big winner was the Brazilian Real, which benefited from a revival in activity on the part of Brazil’s BNDES. Much of that was down to one large transaction for a water and waste concession in Rio de Janeiro. But with incoming president Luiz Inacio Lula da Silva planning to put BNDES and the state sector at the heart of his plans to move his country’s economy forward, the Real may continue to account for an outsize share of global DFI activity.

The big loser in 2022 was the Chinese Yuan, which went from level pegging with the Real to nowhere, with only a single internal transaction appearing in Uxolo’s data. China’s government hopes that the estrangement of Russia from a dollar-based financial system will lead to a greater role for the Yuan. But with the Belt & Road Initiative fading into the background, it looks unlikely that policy lenders will be a vehicle for that ambition.

Sectors

Lending to the financial sector to channel funding to deserving borrowers is still the number one strategy in terms of DFI lending volume. In absolute terms, financing for financial institutions was up handsomely in 2022, from $55 billion in 2021 to $81 billion. But its share of volumes is down from just under a third to a little over a quarter.

Social infrastructure and social projects combined accounted for a little over a third of volume, while traditional energy – a combination of transmission and hydrocarbon-based energy – maintained its third place position off the back of an increase from $19 billion to $35 billion.

Renewable energy increased its share of the development finance market from 4.6% to 6.7%, with $20 billion in total volumes – and climate finance combined with renewables accounted for 11.4% of volume ($35.4 billion). Both signal lending policy is going in the right direction, albeit energy transition lending needs to accelerate substantially and significantly overtake traditional power which is still garnering a greater share of DFI debt.

Subscribers can access the complete Uxolo Development Finance Report 2022 here.

If you are not a subscriber and would like to request access to this report, click here.