Build it and the data will come

The data revolution could be a relatively cheap and key driver for accelerating African development and finance across multiple sectors. But first it needs digital infrastructure build-out – and on a much larger scale than current deal flow.

Reliable, accurate data, or the absence thereof, poses a serious barrier for passing the baton of development finance from MDBs onto private investors. Less than half of all African countries have data to report for eight of the 17 SDGs. Financial market data overall is lacking; African banks struggle to establish the risk profiles of borrowers, causing excessively high interest rates and collateral requirements. A recent survey ranked “inability to agree on value” as the top cause of deal failure across Africa.

Yet, the continent has the fastest growing working-age population in the world, and Ghana’s VP Mahamudu Bawumiaand recently announced that this supply demand imbalance has created a “potent recipe for Africa”. Structures, community networks and training programmes are popping up across the continent for young professionals, further bolstered by technological developments in machine learning, AI and cloud softwares which present a huge opportunity for budding analysts who no longer need the best machines to access the best datasets.

There are therefore two problems for governments and development finance banks to resolve: building out the necessary infrastructure for a confident digital landscape, and training up the data scientists required to analyse it.

Mobile data – the creative solution

Africa faces significant gaps in its ability to capture traditional data, such as tracking income levels, formal and informal employment, and on-the-ground economic activity. On a social level, these absences can lead to serious risks such as during the Coid-19 pandemic. Nearly every country faced difficulty tracking the spread and scale of the pandemic, and this problem was even more acute in Africa; in October 2021, the World Bank had to conclude that six out of seven Covid-19 cases on the continent were likely going undetected.

However, in Ghana, Vodafone Ghana, Ghana Statistical Service, and the Flowminder Foundation created an innovative solution by looking at anonymised mobile phone data. By tracking the movements of active users, insights could be drawn about how effective lockdown measures were in restricting travel – leading to insights much more impressive even than those produced by the UK’s laughable £37 billion Track & Trace app.

Celina Lee, CEO and co-founder of Zindi; the largest pan-African network of data and AI practitioners, argues “interesting initiatives like this are symbolic of Africa’s creative problem solving – why not use things like satellite data, satellite imagery, mobile or telecoms data.”

Africa’s large-scale usage of mobile money indeed poses enormous potential for transforming the continent’s data landscape. The Ministry of Innovation in Togo is currently developing a data project based around conditional cash transfers which will use mobile data to identify the beneficiaries of transfers and use these insights to estimate the country’s poverty levels. And there are a plethora more sources that data scientists could use, from merchant payments, remittances, shopping habits, bill payments, to insurance trends.

Critically, deals are showing that innovations are already sprouting at the source. Africa Mobile Networks recently received a $20 million debt investment from BlueOrchard Sustainable Assets Fund and the OP Finnfund Global Impact Fund I in order to scale up their network services to an estimated 35 million people across sub-Saharan Africa. The more first-time users come onto networks, the more data will be available for establishing a digital landscape.

Where are the projects?

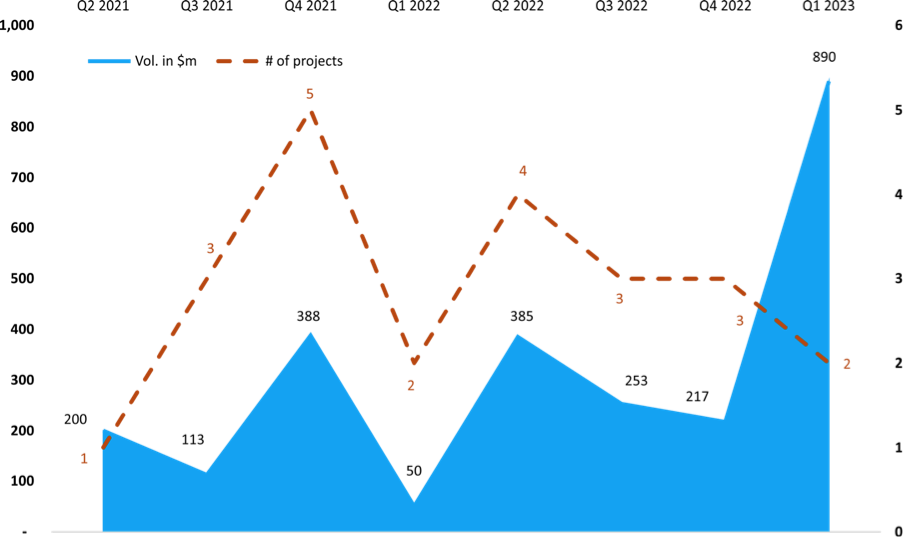

Nevertheless, projects still remain on the scarce side compared to the need – although early 2023 did see a sudden spike in deal volumes, and on-the-ground developers have shown confidence in carrying out projects, which MDBs and DFIs have thrown their backing behind.

Telecoms: Approved and closed DFI debt by quarter 2021-23

In February 2023, Mawingu, an internet service provider based in Kenya, completed its Series B funding round with the help of InfraCo Africa. The $6 equity million investment from InfraCo Africa, along with $1.5 million equity financings from E3 Capital and FMO, will support Mawingu's rollout of infrastructure in Kenya to provide access to affordable internet connectivity.

Two months later, Raxio, Roha and Meridiam raised a sustainability-linked debt facility of up to $170 million in multiple tranches for Raxio Data Centres, a pan-African data centre developer and operator, which included $110 million from Proparco and EAIF.

And in May, one of AfDB’s investment platforms, Africa50, unveiled a new partnership with Bayobab to develop the East2West project, a $320 million terrestrial fibre optic cable network connecting the eastern shores of Africa to those on the continent’s west.

The EIB has also been active under its Covid-19 Digital Africa Loan Envelope. The bank has signed a quasi-equity $10 million financing with BCS for the second phase of the $21 million fibre optic backbone in DRC (the fibre links included in the project will enable high speed broadband in nine towns and will be deployed along 1280 km of railways and on poles stretching along 139 km of road). And EIB is also waiting to sign a $14 million loan agreement with Dalkom Somalia for the construction of the largest submarine cable system in Africa. The total $29 million project would also deploy the first segment of a new national fibre optic backbone, connecting the capital with regional hubs, but has remained under appraisal since December 2020.

The dearth of internet infrastructure does provide an opportunity for developers to get it right the first time; fibre can be put into the ground alongside civil infrastructure like water and sewage. Although caveating this, residential fibre deals in South Africa have not seen any simultaneous infrastructure development.

The Uxolo perspective

Recent developments in data technology have expanded access to the biggest and best datasets without the need for the most expensive equipment. Lee verifies “we were stunned to see some people even coding from their phones. All people actually need is a device that’s connected to the internet to do some of the most advanced analytics possible. But then the turnkey is still getting internet access to everyone”.

Innovations and setbacks persist in consolidating Africa’s digital landscape; a multi-pronged investment approach will be required to make Bawumiaand’s wishes a reality, and boosting up internet access has to be the top priority. Some ground-up private initiatives are achieving outcomes in skills-building and improving access, and seeing local projects find MDB support is promising. Suffice to say, the continent remains a long way off from leading the data revolution – but that doesn’t mean it can't capitalise on the trend.