Improving the bankability of green hydrogen projects: A closer look at offtakes

DFI and MDB support will be required for hydrogen projects in promising developing markets like Africa. But offtake contracts will be key – and even in developed markets offtake contracts can be a major challenge. Leo Klie, Consultant and Columbia Climate School Graduate Student, explores promising offtake structures and solutions to overcome offtake challenges to green hydrogen projects in the EU.

Despite numerous green hydrogen projects announced in the EU, only a fraction (~1%)[1] have successfully reached Final Investment Decisions (FID), and even fewer have secured debt financing from commercial banks.

A significant barrier to the bankability of these projects is the lack of offtake agreements[2]. Despite substantial appetite for hydrogen applications across various sectors such as steel, ammonia or refining within the EU – driven by decarbonization agendas, strategic positioning, or energy security concerns – only a few firm offtake agreements have been signed so far. In a bid to find possible explanations for this, interviews were conducted with 40-plus hydrogen market participants[3] – as well as a review of recent and announced projects – to identify promising offtake structures, issues impeding offtakers to engage in offtake agreements and solutions to overcome these issues.

Market observations regarding offtake structures

According to the interviews and project review, most projects (e.g., Puertollano, CEOG) typically have one major bilateral offtaker[4]. Project co-sponsorship by offtakers is not the norm but has been gaining increasing momentum, for example the Swedish H2 Green Steel project. The offtake agreements are usually long-term offtake agreements, yet, according to developers, there are increasing efforts to cater to offtakers with more short-term procurement habits.

Prices are typically fixed, for example at a price equal to the fixed plus variable costs and a margin. Variable prices are also conceivable according to developers but are currently “not the norm”. Two possible options for variable prices could be either a price linked to an index (incl. floors and caps) or a pre-agreed decreasing price trajectory. Offtakers seemed to have a preference to procure a certain amount of the volume (e.g., 25-50%) at fixed prices and the remainder at indexed prices (e.g., tied to some fossil index).

The expert interviews also revealed that offtake volumes are normally expected to be fixed with take-or-pay provisions, yet sometimes contractual arrangements exist that allow for some flexibility (e.g., 5-10% deviation from the agreed volumes). Fully variable volume contracts have not yet been observed, yet offtakers stated that they would “ideally like to have some fixed and some variable volume components” in their contracts. In the long-run such variable volume contracts with floors and caps are conceivable according to developers.

Overall, the targeted offtake structures are still conservative, aiming for fixed volume and price agreements as well as longer-term offtake agreements. They are thereby more producer friendly, providing revenue certainty, while the offtakers are being locked-in for a longer time. Without this tilting of the balance towards producers the projects might otherwise not be bankable. Going forward the industry is likely to see a slow move towards more flexible volume and price arrangements (incl. renegotiation clauses in case of significant external changes), as “flexible contracts will be key” for offtakers. Furthermore, shorter agreements (<10 years) are likely to become more common as well as alternative offtake structures such as tolling agreements or potentially even flexible offtake agreement in the long-run, “once the necessary infrastructure will be in place”.

Promising offtake structure archetypes

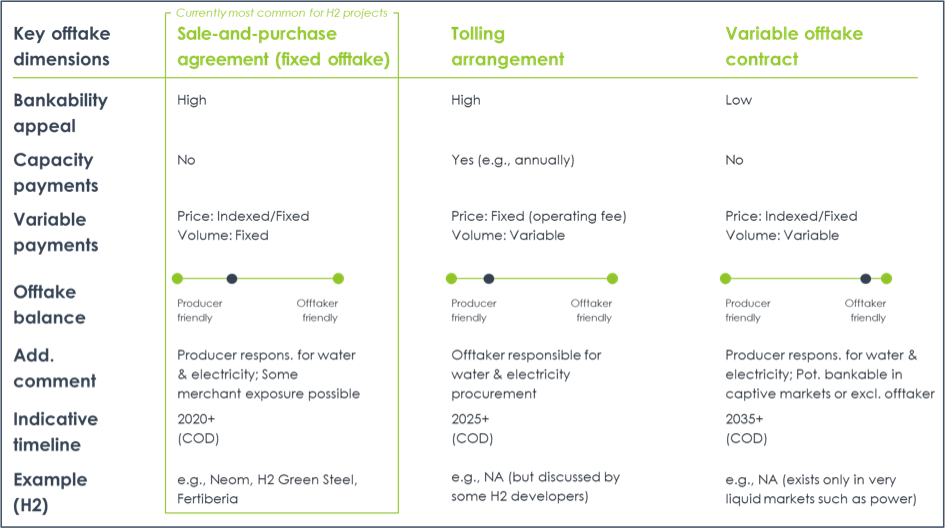

Based on the reviewed projects and conducted interviews three key green hydrogen offtake structure archetypes emerge: sale-and-purchase agreements, tolling agreements and variable offtake agreements (see Figure 1).

Figure 1: Offtake archetypes characterised along key dimensions based on deal review and expert feedback

Sale-and-purchase agreements (with fixed offtake)

Under a sale-and-purchase contract (with fixed offtake agreements) the producer of the hydrogen provides all inputs, produces the hydrogen, and sells it to the offtaker[5]. There are no fixed capacity payments, yet the offtaker pays the producer a fixed or variable (indexed) price for the fixed volumes. This type of agreement is very producer friendly, as it provides the producer with a very predictable cash flow, which makes it highly bankable. So far, this archetype is the most common type of offtake agreement and similar structures have been used in the case of Neom or H2 Green Steel. Reasons for its popularity are for instance the higher predictability (on both sides) and in some cases the lack of structuring knowledge on the offtaker side.

Tolling agreements

In the case of a tolling model, the offtaker supplies the electricity (and the water) to the hydrogen producer. The hydrogen producer owns the electrolyzer and gets paid a capacity payment for providing the electrolyzer capacity as well as a utilization fee when the electrolyzer is used. The price of the utilization fee would typically be somewhere near the actual variable costs (plus a potential margin). The volume would be variable. Overall, this kind of agreement can be very bankable, if the producer gets variable payments to cover any OPEX and a fixed payment to recover any CAPEX. This archetype can make sense for the offtaker, if the offtaker is in a better position to secure the electricity (due to better market knowledge or negotiation power). Yet, this archetype (commonly used in LNG liquefaction and regasification infrastructure) is still very unusual, as the offtakers typically lack in-depth structuring and power market understanding. An offtake agreement with capacity reservation as well as variable recurring payments seems to be already discussed for the oxygen offtake of the Danish HySynergy project.

Variable offtake contracts

In a variable or on-demand contract the producer procures all inputs and sells it on-demand to the offtaker(s). The volume and price would be variable, whereby the price would likely be tied to a market index. Given its flexibility, this archetype would be very offtaker-friendly and less bankable due to the higher revenue risk. From a producer’s perspective such an offtake contract can make sense if the producer was selling to one or multiple offtakers in a captive market with limited and more expensive alternatives. These kinds of (quasi merchant) offtake schemes have not been used for hydrogen projects yet.

Six key issues impeding offtakers in the EU

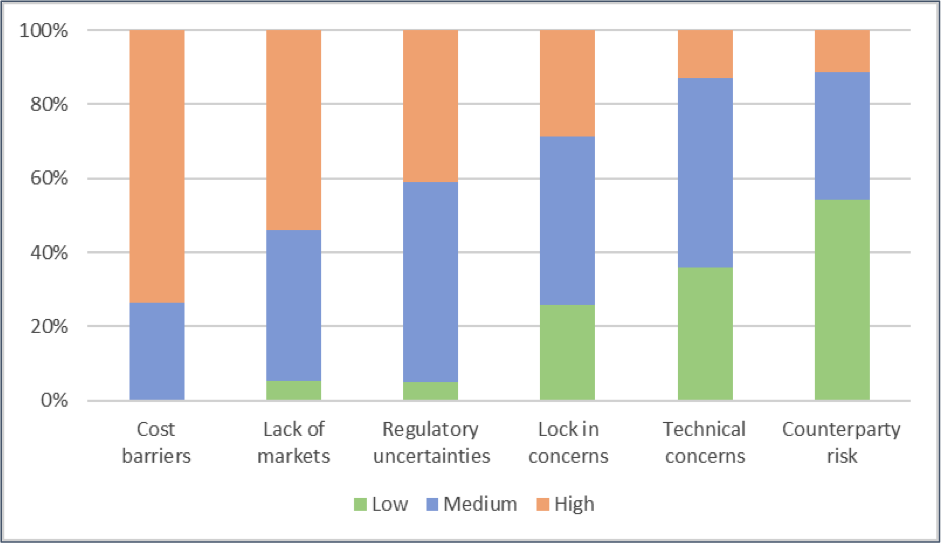

Despite the range of potential offtake structures, only a few projects in the EU have successfully secured firm offtake agreements to date (e.g., H2 Green Steel, HySynergy, Puertollano). The interviews conducted revealed six key issues preventing offtakers in the EU from entering into offtake agreements: Cost and competitiveness barriers, the lack of green markets (incl. the inability to pass on costs), regulatory uncertainties, lock-in concerns, technical concerns and counterparty risks. The most important issues, based on the expert feedback, are cost barriers and the lack of established markets for green products. Regulatory uncertainties and lock-in concerns are of moderate relevance, while technical concerns and counterparty risks are of lower relevance (see Figure 2).

Figure 2: Relevance of key offtake issues according to expert feedback

Solutions for developers and policy makers to address issues

According to the interviewees, actions by developers and policymakers are needed to overcome these issues. While actions by developers, such as establishing cost pass-on mechanisms and mitigating technical and counterparty risks, are crucial, the consensus was that actions by policy makers are even more critical - especially when it comes to addressing the most significant issues such as cost barriers, lack of markets and regulatory uncertainty, where “you are absolutely relying on government measures” according to one expert.

Actions by developers

Developers can more clearly communicate the hedging and security of supply benefits of green hydrogen, introduce protective contracts, guarantees, and insurances, offer more customer friendly offtake agreements and build out strong partnerships.

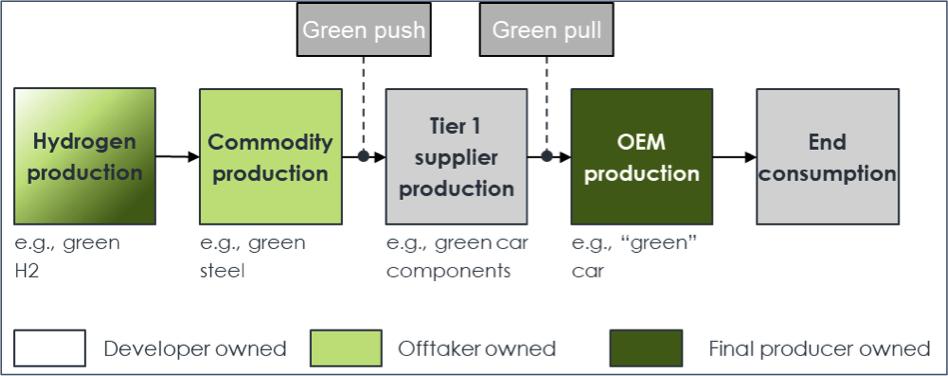

One of the most promising measures developers might take would be to form joint ventures with offtakers that enable the higher costs of green hydrogen (products) to be passed-on throughout the value chain, as “the challenge is too big to take it on alone”. These sorts of arrangements can be observed in the case of Neom or H2 Green Steel, where the offtaker and/or a player further down the value chain would have an equity stake in the hydrogen production project (see Figure 3). This type of partnership creates trust and transparency as well as an alignment of interests. Most importantly it creates a pull and push for green hydrogen (products) and a pass-on of the costs to final consumers, where 70% of the customers are willing to pay a premium of up to 5%, while the price increase of the final product using green hydrogen can be as little as 1%[6].

Figure 3: Illustration of a joint venture structure with partners along the value chain

Actions by policy makers

Policymakers can stimulate green markets by introducing mandates/quotas (incl. penalties), which is “extremely important to create markets” according to one developer, and by leveling the playing field between green and grey hydrogen e.g., by increasing the carbon prices within the European Emission Trading System (EU ETS).

To address the most important issue of cost/competitiveness barriers, policy makers in the EU should boost support mechanisms such as the European Hydrogen Bank’s (EHB) auction mechanism or introduce simple, yet powerful subsidies in the style of the Inflation Reduction Act (IRA) enacted by the US in 2022.

The EHB auction is an auction mechanism aiming to provide developers with bankable offtakes and offtakers with more affordable feedstock. The auction rewards green hydrogen producers with a fixed premium (of up to 4.0 €/kg) produced for a maximum of 10 years. The first auction will award €800 million, yet critics say that this is not enough to kick-start Europe’s hydrogen economy. Some experts in the European market envy the straightforward and generous section 45V subsidy of the US Inflation Reduction Act, which can offer a hydrogen production tax credit (PTC) of between $0.60-3.00 per kg of hydrogen based on the hydrogen’s lifecycle carbon content. Either way, more support is needed according to the experts to address the cost barrier, enable more offtakes, facilitate the bankability of hydrogen projects, and therefore boost the hydrogen economy and accelerate the energy transition.

[3] Most experts were either project developers (21%), offtakers (19%), professionals working in academia or for research institutions (19%) or consultants (17%). Other frequently interviewed experts were lawyers, investment professionals or banks. Almost all experts were from within the European Union (e.g., DE, NL, FR, ES, DK, IT), while a few selected experts were from the US or UK.

[4] One exception is the H2 Green Steel project in Sweden, where offtake agreements for green steel have been signed with more than five offtakers incl. Mercedes-Benz, Marcegaglia and Cargill.