Unveiling Insights: Uxolo Development Finance Report 2023

Dive into some of the key highlights from Uxolo’s development finance report, assessing the market’s concerns and focuses amidst a landscape of growing investor caution.

The 2023 edition of Uxolo’s annual development finance report is here, offering an in-depth, down-to-earth look at development finance activity and trends over the last twelve months. This year’s report marks the second time Uxolo has utilised a survey to gather data, which was complemented by a series of semi-structured interviews with key market participants. Below you can find some highlights from the report.

This year’s report strived to assess the effects of rising inflation and interest rates, the intensifying climate crisis, and the challenges associated with mobilising sufficient private capital in an environment where investor caution continues to grow.

How has private capital mobilisation fared?

Overall, respondents identified increased opportunities for private mobilisation as the market's top prospect. Private mobilisation also took the lead in market opportunities, closely followed by interest in innovative financing structures and viable project pipelines. Despite global instability, this signals a reassuring demand for projects that are both viable and bankable.

However, the majority did observe a recent decrease in private sector investments in their projects. The report hints at multiple reasons but, interestingly, the impact of soaring interest rates has divided market sentiment. While a majority anticipated decreased private sector attractiveness in development finance as a result of high interest rates, a significant cohort still harboured optimism, seeing increased interest in the sector, and only 31% reported that this was a significant cause for concern.

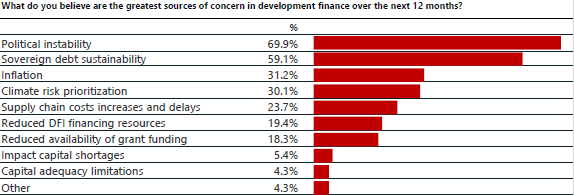

Perhaps the more significant market threat to watch in 2024 will be political instability, which 69.9% of respondents highlighted as their greatest source of concern, closely followed by sovereign debt instability, which 59.1% of respondents highlighted.

Climate action: mitigation dominates

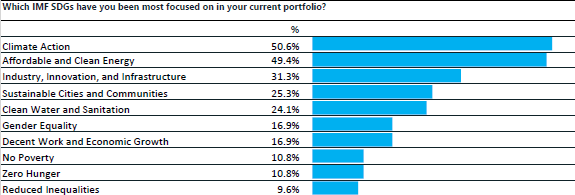

One standout finding was that the renewable energy sector, deemed both a challenge and opportunity by participants, is generating significant interest in the development finance community but facing the most delays in project signing times. The report found that the climate mitigation-aligned SDGs, namely SDG 13: Climate Action and SDG 7: Affordable and Clean Energy, were the top focuses in participants’ portfolios across both the development and private finance sector.

While encouraging, the dominance of these goals raises questions about the attention given to other vital global development objectives – most strikingly, the SDGs associated with biodiversity and conservation, SDG 14: Life Below Water and SDG 15: Life on Land, landed at the very bottom for focus within portfolios.

Dive into the Uxolo Development Finance Report 2023 for a deeper understanding of these, and many more, findings!

If you are an Uxolo Intelligence subscriber, login and access the report here.

If you are not currently a subscriber, you can request a copy of the report here.