Uxolo's development finance trends of 2023

2023 was the year of innovation for development finance, circled by the ongoing discussion around the G20 Capital Adequacy Framework (CAF) report and how MDBs can be better, bolder, and bigger. Ideas around callable capital, hybrid capital bonds, and redirecting SDRs could very well lead to the same success that MDB portfolio programmes and debt-for-nature swaps have had this year: if concerns around political instability and the neglect of biodiversity issues don’t dampen spirits.

This year debt-for-nature swaps evolved into a tried-and-tested instrument which most in the development finance network now have on their radar. May’s Ecuador deal achieved a record $1.126 billion of savings in principal and interest repayments and channelled $450 million into Galapagos conservation. August’s Gabon deal marked the first in Africa and the first to face the challenge of a coup a mere fortnight after signing – fortunately, the $500 million blue bond only dropped by two points, demonstrating the resilience of the DFI-backed instrument. At COP28, MDBs have now officially agreed to launch a debt-for-nature swap taskforce, initially chaired by IDB and DFC.

Despite this seeming penchant for conservation, the Development Finance Industry Report 2023 revealed that SDG 14: Life Below Water and SDG 15: Life on Land are at the bottom of respondents’ portfolios, even though 43% expressed a keen interest in nature-based solutions – indicating a clear gap in between idea and reality in financing conservation (and making debt-for-nature swaps all the more unique).

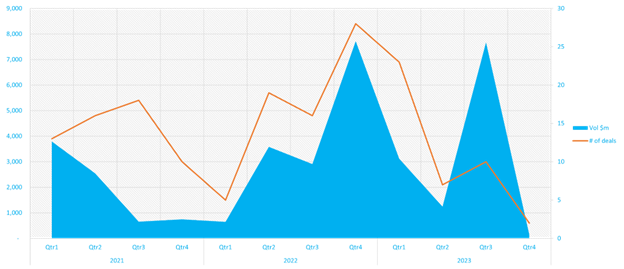

Speaking of disappointing numbers, Convergence’s State of Blended Finance 2023 report revealed that climate blended finance volumes have sunk to their lowest point in the last decade. Uxolo’s data, which includes approved and closed deals, told a similar story with the number of sustainable deals with a private sector participant on the lender list hitting their lowest point since 2021. Many now accept that the once widely repeated 'billion to trillions' narrative is dead, prompting a reevaluation of how MDBs will engage private finance differently in 2024.

Sustainable development financing with private sector lender participants, 2021-2023

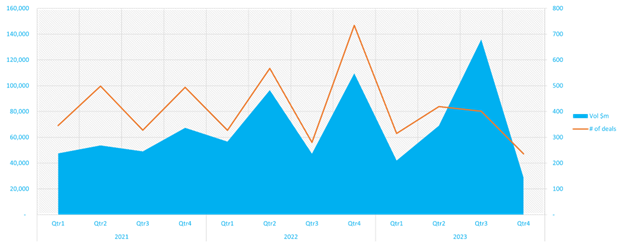

Perhaps then the most important development finance trend of 2023 is the ongoing discussion on actioning the Triple Agenda: Better, Bolder, and Bigger MDBs which followed the G20 Independent Review of MDB's Capital Adequacy Frameworks (CAF) report. From callable capital to hybrid capital to SDRs, the routes for enhancing MDB financing are multifold and will be vital for determining how development finance is going to accelerate sustainable development, finance the energy transition and find the capital – private and public – to do it. As Uxolo’s data shows, development finance total volumes have been trickling up over the past three years, but are still nowhere near the $3.9 trillion a year needed to fill the SDG financing gap, according to the OECD (2022).

Development finance total volume of approved deals, 2021-2023

Anyone not watching this space should begin now and, for a starting point, might we suggest Uxolo’s new series on ReImagining MDBs which will be granularly breaking down the key dimensions with industry experts.

There are a couple of other financial tools that have shown real promise in 2023; for one, guarantees have proven to be adept at combining local currency, capacity building and capital into one neat box. SocGen and GuarantCo partnered to provide XOF 37.8 billion to finance a fleet of EV bikes in Benin and Togo; GuarantCo provided an NGN20.23 billion counter-guarantee to InfraCredit for Lagos Free Zone Company’s 20-year infrastructure notes; and MIGA documented a record year, issuing $6.4 billion in new guarantees across 40 projects in 29 countries, its highest volume since the institution was founded.

After a year wrought with conflict, it is not too surprising that Uxolo survey respondents rated political instability as the greatest concern for development finance over the next 12 months by 70% – and guarantees could well become the necessary item in the toolbox for improving the bankability of 2024’s project pipeline.

Last but not least, 2023 saw record volumes of CPRI and development finance collaboration. The latest edition of the IFC Managed Co-Lending Portfolio Programme mobilised $3.5 billion from 13 insurance companies which the MDB will use to support more than $7 billion of new medium and long-term loans. The operation managed to earn the labels of “efficient” and “simple” from the private sector – a rare and significant achievement for an MDB – although it is unlikely smaller and newer DFIs will be able to copy such a feat. Even if it is just single-risk projects that remain the bread and butter of the market in 2024, there is still plenty of room for innovative collaborations that can, once again, soften the impact of political instability risks.

Watch the Uxolo highlights of 2023 video!