Funding African development: Could it be faster, more impactful and cheaper?

Cost of debt and mobilisation of private capital for Africa – could both be done better and cheaper? It’s a $170 billion per year question according to estimates from the OECD of what Africa needs to bridge its infrastructure gap and generate sustainable growth. So what needs to change? Join Uxolo’s open access virtual roundtable on 10 September to find out.

There is no argument that the high cost of African debt is, for a host of reasons, out of kilter with the risk reality. And private capital mobilisation presents many challenges for anything that is not commodity-linked or has a US dollar-based income stream.

To get into the granularity of the problem, and potential solutions that will not require radical systemic change, Uxolo has put together a panel of MDB, DFI & private capital leaders for an open access live virtual roundtable on 10 September 2024 at 2:30pm BST / 9:30am EDT.

The broad-reaching discussion will be looking at African default rates, the effects of rating agencies on African sovereign & project debt costs, perceived versus actual risks, local capital markets, bringing down the cost local currency hedging & PRI, how DFIs can improve the bankability of projects, equity bridging, blended finance, concessional financings, institutional investor buyouts of DFI projects and much more.

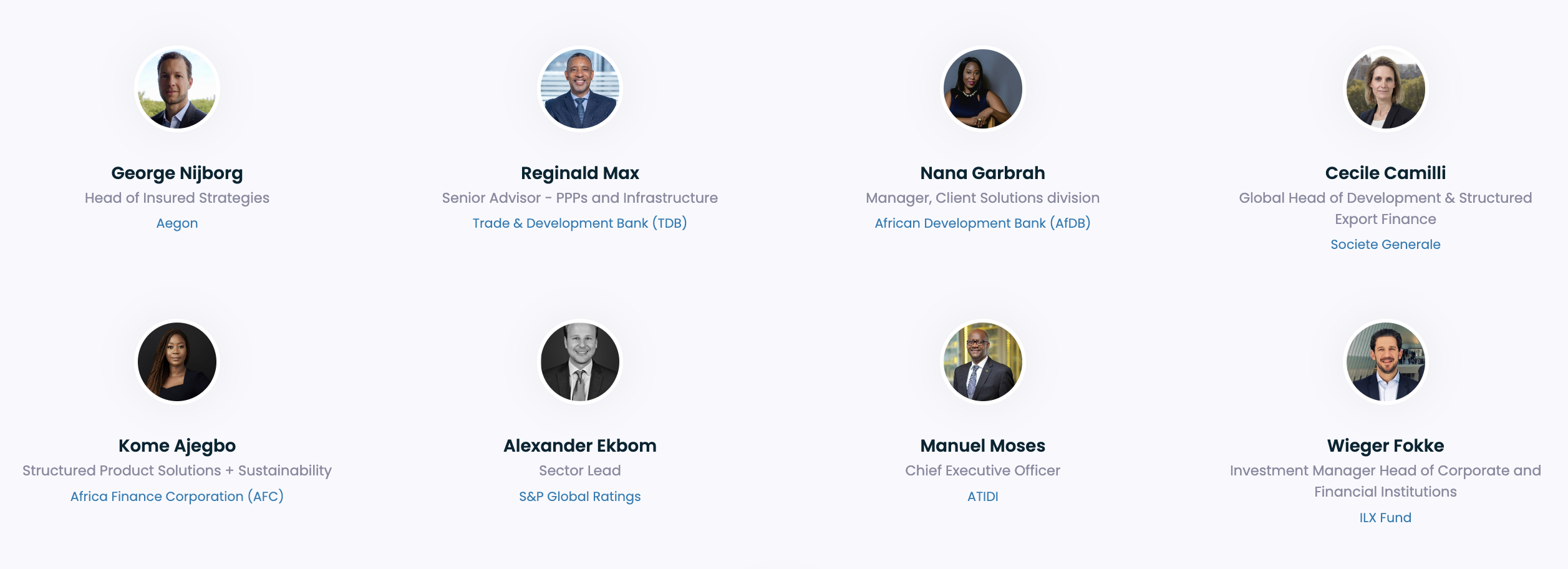

Editor of Uxolo, Sean Keating, will be joined by:

Our discussion leaders will consider:

- Debt vs. Equity Mobilisation: With many African states heavily indebted, should mobilisation focus on sustainable equity rather than adding more unaffordable debt?

- Cost of Sovereign Borrowing: Is Africa paying too much for sovereign borrowing compared to similarly rated sovereign credits in other regions, and why is this happening?

- Ratings Agencies' Methodologies: Are rating agencies using outdated methodologies that inflate the cost of African sovereign debt despite strong economic growth?

- Local vs. International Mobilisation: Should the focus shift from international DFI support to local mobilisation via local capital markets and repo development?

- Improving Bankability: What steps can DFIs and borrowers take to enhance the bankability of African projects and get more projects into the pipeline?

How to Register: Registration has now closed

Sign up to receive our Weekly Newsletter for the latest development finance updates, exclusive insights, and benefits.