Ukrainian risk: DFIs needed to combat limited local capital

DFI support to Ukrainian borrowers dropped significantly over the past few years. Now, US DFC’s deals are on hold amid resource extraction remuneration, small tickets dominate deal flow, and local insurers’ capital is stretched. And as the Russia-Ukraine war amplifies, so does the perception of war risk for DFIs and international banks.

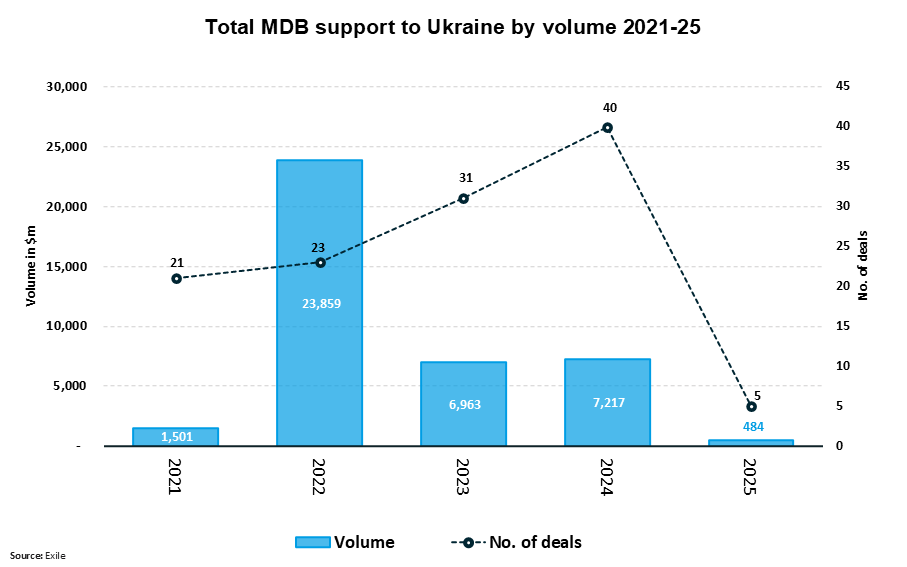

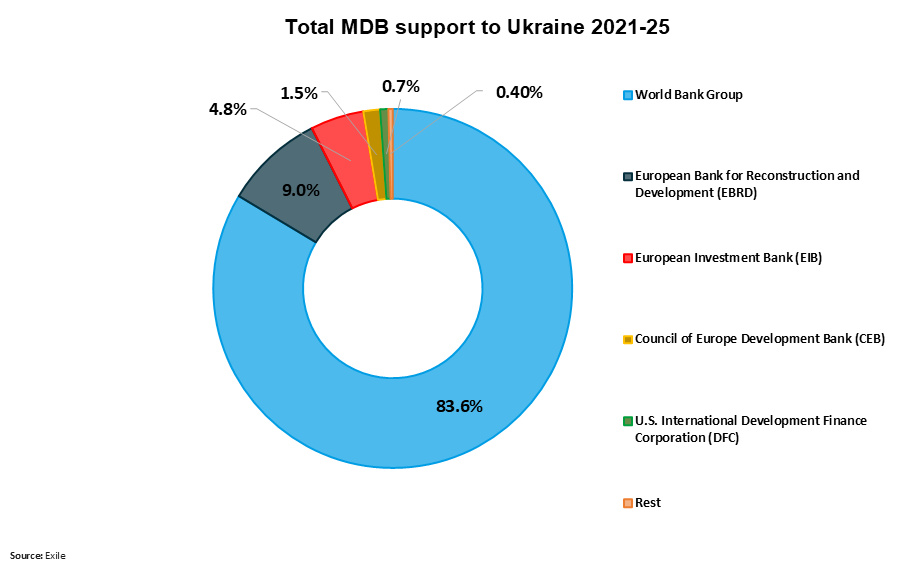

MDB financings to Ukrainian borrowers have been muted and international financings scarce in the wake of the Russia-Ukraine war. In 2022, there was a spike in DFI-backed deal volume to $23.8 billion with an average ticket size of $1.03 billion across 23 deals. This uplift is symptomatic of MDBs — namely the World Bank and its organs (IFC, IBRD and IDA), EBRD and EIB — promptly responding to the full-scale invasion by providing big-ticket emergency war relief packages, mostly to sovereign utilities across energy and water infrastructure, and agriculture and logistics.

Yet, DFI support significantly decreased in 2023 and 2024, with only $6.9 billion (across 31 deals) and $7.2 billion (across 40 deals) allocated respectively. With volumes dropping by roughly 30% and the number of deals rising over that period compared to 2022, the average ticket size fell sharply. Proceeds were often for social projects, including energy infrastructure, logistics recovery, education and housing.

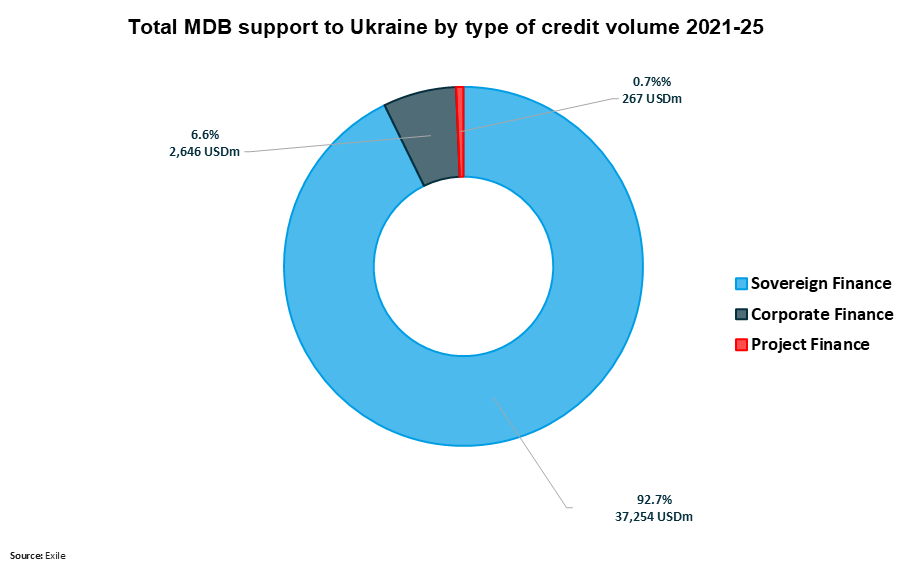

Sovereign finance accounted for 92.7% of all MDB support to Ukraine between 2021-25, with only 6.6% allocated to corporate borrowers. Prior to the invasion, appetite for corporate risk was strong among DFIs. Agriculture and energy firms — for example, Nibulon, Ukroliya and Ukrenergo, received consistent support, the highest ticket of $300 million being extended to the Ukrainian agribusiness giant Kernel in 2021, in the form of blended pre-export finance and BSTDB-backed direct loan.

Nearly seven months into 2025, total deal volume sits at the lowest level since the war began, with only $484 million stretched across five deals. And while H1 figures are partially incomplete, given late deal submissions, this subdued figure is alarming.

Empty promises?

Despite a flurry of pledges DFC made over the past year, the institution’s aggregated contribution to Ukraine has been alarmingly minuscule at $290 million since the war began, according to Uxolo Intelligence.

For instance, in 2024, DFC announced a new $357 million financing package, including various political risk insurance transactions directed towards unnamed borrowers in the agricultural, manufacturing and education sectors. DFC also announced a $28 million loan portfolio guarantee to ProCredit Bank Ukraine, co-sponsored by USAID, aiming to support lending to small local businesses. However, whether these loans have been deployed in practice remains unclear, pointing to a possible gulf between US rhetoric and the reality of development finance support on the ground.

What is clear is that DFC’s involvement in Ukraine is on hold for now, as in-progress deals were frozen by the Trump administration until a new DFC head is appointed. This does not bode well for critical infrastructure support on the ground.

Covering war risk – no DFC losses to date

Last summer, DFC announced a $350 million reinsurance facility, brokered by Aon and distributed by ARX (a Ukrainian subsidiary of Fairfax) to provide war risk insurance to companies operating in Ukraine. According to one broker working on the deal, the transaction signed and insurance was provided to clients – with DFC suffering no losses to date. Equally, he pointed out that local carriers carefully distinguish eligibility for DFCs reinsurance facility, focusing on clients whose activities directly benefit Ukraine. This way, no export-focused businesses qualify for this risk coverage.

While hope remains that DFC will continue reinsuring Ukrainian insurance providers under its new leadership, considering its managerial role in the US-Ukraine Investment Fund, DFC is likely to prioritise projects in critical minerals and natural resource extraction.

Before the invasion, UK’s Lloyds Bank was the key provider of war risk reinsurance to Ukrainian businesses, which were not extended upon expiry due to its heightened war risk perception. Given the tenfold increase in Russian drone attacks between June 2024 and 2025, it is unsurprising that DFIs and international lenders are pulling away from Ukraine. It is not that DFI capital is stretched; rather, the risk is truly immense, and losses are high.

Local insurance providers, on the other hand, are short on capital to cover Ukrainian business risk, limiting their capacity to insure large contracts. Fixed assets are most vulnerable to destruction, and therefore are less likely to be covered than goods in transit. Following our source at Aon, some local carriers remain keen to cover assets situated in Western Ukraine because it is further away from the frontline – but not in Kyiv, which suffers more attacks as a strategic war target.

Plunging into agribusiness

According to Uxolo data, DFC’s contribution to Ukraine’s economy accounts for 0.7% of total DFI support between 2021-5. The focus so far has been food and agriculture, including a $250 million direct loan to Ukraine’s major poultry and grain producer, MHP, in 2023. The loan was intended to assist the company’s refinancing needs for existing debt, as well as fund new storage, transportation capacities and electrical backups. This would enable MHP to continue their production and export acivities, helping to stabilise Ukraine’s fragile economy.

In line with the objective to combat war-driven food insecurity, DFC approved a $40 million loan to an agricultural group Astarta in early 2025, financing the construction and operation of the first Ukrainian soy protein concentrate plant. This was the second and final approved deal from the DFC, directed at Ukrainian borrowers between 2021-5.

IFC also expressed interest in supporting this project, which promises to create new export opportunities, support agricultural activity and create around 3,000 jobs. Due to high processing, soy protein concentrate has higher value added than pure soybean, allowing for higher revenue yields which are so crucial for Ukraine’s long-term economic recovery.

US-Ukraine Investment Fund: Benevolent lender, or resource extractor?

Earlier in April, US and Ukraine’s representatives signed an agreement to form a ‘reconstruction investment fund’, aimed at financing long term development projects in Ukraine in light of the war-induced destruction. The US Treasury Department and DFC will partner on making financial contributions to the fund, in return for preferential access to new deals concerning Ukraine’s natural resources.

While described as ‘equal partnership’, whereby the board will consist of three US and three Ukrainian representatives, this deal remains contentious because it empowers the US to benefit from Ukraine’s resources throughout and beyond the war. This also highlights the controversy in DFC’s mandate, being a development-focused institution, to “supporting U.S. interests, and delivering returns to American taxpayers.” Time will tell whether DFC has indeed become a vessel for military aid renumeration via extraction of natural resources under the second Trump administration.

The cautious return of export credit finance

While DFIs display poor risk appetite for backing Ukrainian corporates and SMEs, ECAs resumed supporting strategic foreign investments in Ukraine from 2024. Scandinavian ECAs are leading the way: for instance, Finnvera backed a $27.5 million credit facility to a Ukrainian steelmaking giant Metinvest in July, distributed by Deutsche Bank. This was possible due to a special loss commitment by the Finnish Ministry of Economic Affairs and Employment, as previously the ECA could not grant export credit guarantees to countries at war.

Finnvera continues supporting Ukrainian businesses as it partnered with European Investment Fund to grant additional export credit guarantees, worth around €30 million, to Finnish small businesses which trade in Ukraine. When distrubuted, this would allow Ukrainian firms to continue international trade and acquire necessary goods and equipment to fulfil their own projects, stimulating Ukraine’s economy.

Earlier in January, a Danish ECA EIFO backed a $420 million project financing of the second phase of the Tiligul wind farm in the south of Ukraine, distributed by Danske Bank. Designed by a Ukrainian private energy firm DTEK, this is the largest Ukrainian wind farm. Upon completion, it will have capacity to supply electricity to 900,000 households once completed; this is especially pertinent considering the onoing war damages to Ukraine’s energy infrastructure.

According to the broker, Scandinavia’s interest in Ukraine can be explained by the government-level commitments to supporting the reconstruction of Ukraine, pushing ECAs to implement guarantees despite the risks. Additionally, given the close proximity of Nordic countries to Russia, and Finland and Sweden recently joining NATO in response to the war in Ukraine, gaining first-hand experience in re-building a war-torn country may be a precautionary measure in case their relations with Russia deteriorate.

UKEF also displayed comradeship, signing s facility agreement with Ukraine’s Minister of Finance this July to finance the improvement of Ukraine’s air defence capabilities. The guarantee amounts to nearly £1.7 billion, accounting for 79% of the entire ECA deal volume in 2025. The funds will be directed for procurement of defense materials and other goods and services in this sector from the UK. Considering the intensifying air-borne attacks on Ukraine this summer, this agreement promises to empower Ukraine’s military efforts, although more support in defence sector is needed.

The Uxolo perspective

With DFIs cautious to lose funds due to heightened war risk, a financing gap is created which leaves local insurance providers short on resources to support local businesses. Since risks of destruction are real and high, Ukrainian insurers are themselves reluctant to extend coverage to large-ticket projects to avoid high losses.

DFI and ECA support is paramount to mobilising international and local bank capital, either via reinsurance facilities, defence mechanisms, project finance and reconstruction funds. The growing ECA appetite to support Ukraine-based projects is good news, but while this creates new financial flows, employment and trade opportunities, more needs to be done to support SMEs and corporates on the ground as stronger credits and larges corporates (like Metinvest and DTEK) continue to garner the lion’s share of ECA support.

Learning from the Nordics, decisive government policies and state-level partnerships are key for incentivising MDB involvement in Ukraine, calling for more proactive international cooperation and support provision. Greater collaboration between DFIs and ECAs will be sure to create a more holistic approach to big-ticket project financing, especially during the reconstruction of Ukraine after the war ends, but also now. Ultimately, the root cause of war risk and the DFI retreat from Ukraine is the war – hence, above everything, international partners ought to help tackle it.