Turkiye reaches deal on $6.75bn financing for cross-Bosporus rail link

Turkiye has reached a preliminary agreement to sign $6.75 billion in financing for the Northern Railway Crossing Project, a...

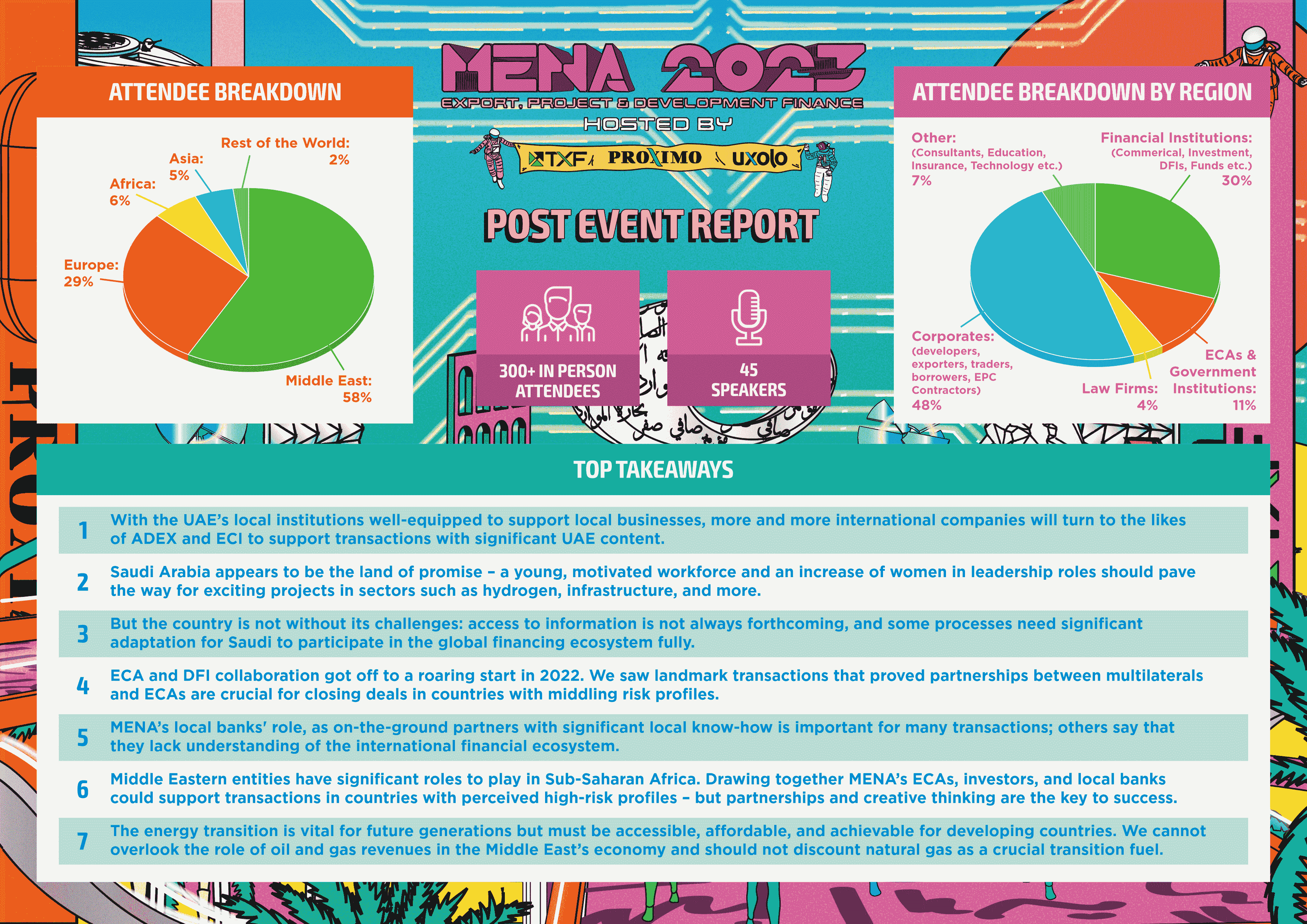

For the first-time we combined forces with our sister brands TXF & Proximo for a bumper networking MENA event which brought together the Export, Project & Development Finance industries...

Collaboration between Africa and the Middle East has arguably never been greater with many key players looking to reap the benefits of a promising trade corridor between the two regions.

Moreover, burgeoning use of Dubai as a trading hub for the Middle East make it a ripe location to gather a deal-hungry attendee list from leading exporters, borrowers, EPCs, ECAs, developers, lenders, investors, ECAs and other key project, development and export finance players!

Top takeaways from the event:

☆ With the UAE’s local institutions well equipped to support local businesses, more and more international companies will turn to the likes of ADEX and ECI to support transactions with significant UAE content.

☆ Saudi Arabia appears to be the land of promise – a young, motivated workforce and increase of women in leadership roles should pave the way for exciting projects in sectors such as hydrogen, infrastructure, and more.

☆ But the country is not without its challenges: access to information is not always forthcoming, and some processes need significant adaptation for Saudi to be a full participant in the global financing ecosystem.

☆ ECA and DFI collaboration got off to a roaring start in 2022. We saw landmark transactions that proved partnerships between multilaterals and ECAs are crucial for closing deals in countries with middling risk profiles.

☆ MENA’s local banks role, as on-the-ground partners with significant local know-how is important for many transactions, others say that they lack understanding of the international financial ecosystem.

☆ Middle Eastern entities have significant roles to play in Sub-Saharan Africa. Drawing together MENA’s ECAs, investors, and local banks could support transactions in countries with perceived high risk profiles – but partnerships and creative thinking are the key to success.

☆ The energy transition is vital for future generations, but must be accessible, affordable, and achievable for developing countries. We cannot overlook the role of oil and gas revenues in the Middle East’s economy, and should not discount natural gas as a crucial transition fuel.

Uxolo Subscribers: Get free virtual access to this hybrid event via your portal. Don't want to miss out? Contact intelligence@exilegroup.com to find out how. For subscribers to our 'Leader' package, don't forget you get 30% off the full rate! Contact us here for the discount code.

For access to all of the on day recordings contact: intelligence@exilegroup.com

VENUE

We are please to announce that MENA 2023: Export, Project & Development Finance will be held at the Ritz Carlton Dubai in the United Arab Emirates.

ACCOMMODATION

We have a preferential room rate available to registered attendees of 2165.00 AED (single occupancy) per night. The rooms are available across the key event dates.

BOOK HERE to secure your place. The deadline for our preferential room rate is 22nd February, so make sure you book early.

Please note that all queries and cancellation requests will need to be discussed directly with the hotel.

For more information on our event logistics please contact operations@uxolo.com